How does carbon pricing work?

Carbon pricing has been shown to work because price influences consumer behavior. By assigning an economic value to carbon emissions, carbon pricing provides an economic incentive for households and businesses to reduce fossil fuel consumption. It is a market-based tool with demonstrable efficacy in the real world.

British Columbia (BC) was the first Canadian province to introduce an economy-wide carbon tax. As a result, BC’s greenhouse gas emissions are 5-15% lower than they would have otherwise been in the absence of the carbon tax. The emissions reductions are the results of various behavioural and investment shifts.

Does the federal government have the authority to impose a carbon tax in Manitoba?

In 2016 the federal government announced that beginning in 2018 all provinces and territories must have a carbon pricing system in place that meets certain conditions (the benchmark). If jurisdictions choose not to introduce a carbon price, the federal government will exercise its constitutional authority and impose one (the backstop).

The Manitoba government sought an independent legal assessment of the federal government’s constitutional authority to impose a nation-wide carbon price. The expert legal opinion concluded that the federal government has the constitutional authority to act in the absence of a credible provincial emissions reduction plan that achieves equivalent environmental objectives. In other words, if we don’t act the federal government will impose their plan on Manitoba.

What is the federal backstop?

The federal system, or backstop, would impose a carbon tax in Manitoba of $20 per tonne in 2019, rising by $10 per tonne each year, to $50 per tonne by 2022.

How is the Manitoba Carbon Price Different from the Federal Carbon Price?

The Made-in-Manitoba plan differs from the federal backstop in two key aspects:

- The Made-in-Manitoba carbon price will cost Manitoban’s less than the federal system over the 5-year period (2018-2022)

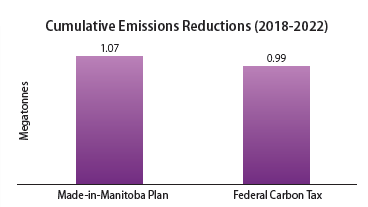

- The Made-in-Manitoba carbon price will result in greater emissions reductions than the federal carbon price

Costs Less, Reduces More

By staying at $25 per tonne and not rising, the Made-in-Manitoba carbon price costs Manitoba families and households less.

From 2018-2022, the average Manitoba household will save an estimated $240 under the Made-in-Manitoba plan compared to the federal plan. In 2022 alone, when the Made-in-Manitoba price will be half the federal price, Manitoban’s will save $240.

In total, Manitoba taxpayers and businesses will pay about $260 million less in carbon taxes under the Made-in-Manitoba plan compared to the federal plan.

Read this fact sheet for a better understanding of what the Made-in-Manitoba carbon price will mean for families and households.

Costs Less,Reduces More

By starting at a higher rate than the federal price, the Made-in-Manitoba carbon pricing system will result in greater emissions reductions at the start, and those reductions will build up faster.

By 2022, the Made-in-Manitoba carbon pricing plan will result in an estimated 80,000 tonnes more emissions reductions than the federal backstop would have, if it had been implemented in Manitoba.

Watch this short video to learn more about Manitoba’s clean energy advantage, and the differences between the federal and Manitoban carbon pricing systems.

What will happen to the revenue generated from the carbon tax?

The Manitoba carbon tax will be revenue neutral. Money collected from the tax will be redistributed back to Manitobans through a variety of measures, such as personal income tax relief and small business tax reductions.

There are also opportunities for Manitobans to save money by lowering their carbon footprint. For example, this can be achieved by choosing more energy efficient products, idling our vehicles less, or changing our commuting patterns. By lowering our carbon footprint, while at the same time receiving the benefits of income and business tax relief, many households will be able to reduce their overall tax burden.

Who is exempt from the carbon tax?

An exemption is in place for Manitoba’s farmers. Read this fact sheet for more information on what the Made-in-Manitoba Climate and Green Plan and the carbon price means for the agricultural sector.

Large industrial emitters are not exempt from the carbon tax. They are covered by Manitoba’s output based pricing system (OBPS). Under the OBPS certified large industrial emitters are given emissions intensity targets. If an industry exceeds their target, they must pay the same carbon tax rate as all Manitoban’s, or remit an emissions credit.