Fiscally

Responsible

Outcomes and Economic

Growth

Strategy

Borrowing and Debt Management Strategy

Manitoba borrows to fund the government deficit, refinance maturing debt, fund capital investments and other non-budgetary borrowings such as funding the public pension liability.The Manitoba government also borrows on behalf of Manitoba Hydro, with the principal and interest payments as well as a debt guarantee fee recoverable from the Crown corporation.

The borrowing authority allowing the minister of finance to raise funds on behalf of the province is set out in the Financial Administration Act. Proposed amendments will set limits on the outstanding debt for the provincial government and Manitoba Hydro. The limits include authority for new cash requirements for the year plus a contingency amount. The proposed amendments will also allow for an increase in authority in extraordinary circumstances, such as a pandemic, similar to what was done in fiscal year 2021/2022 with an increase of $5 billion of authority to allow for COVID-19-related borrowing.

Debt Management Strategy

To ensure market availability to complete its borrowing program, Manitoba raises funds in both domestic and international capital markets. The domestic market is the primary source for the province for both short- and long-term funding. Manitoba has a well-established short-term borrowing program. This provides the Manitoba government with a cost-effective source of financing while also providing liquidity. These financings are primarily raised through the weekly 91-day Treasury-Bill auction. To augment the Treasury-Bill program, there is also authority in place to issue promissory notes for immediate cash requirements if needed.

In the domestic long-term market, the focus is on ensuring large benchmark issues in both the 10- and 30-year terms. This creates a robust secondary trading market in Manitoba bonds that investors require, ensuring ongoing interest when looking to issue.

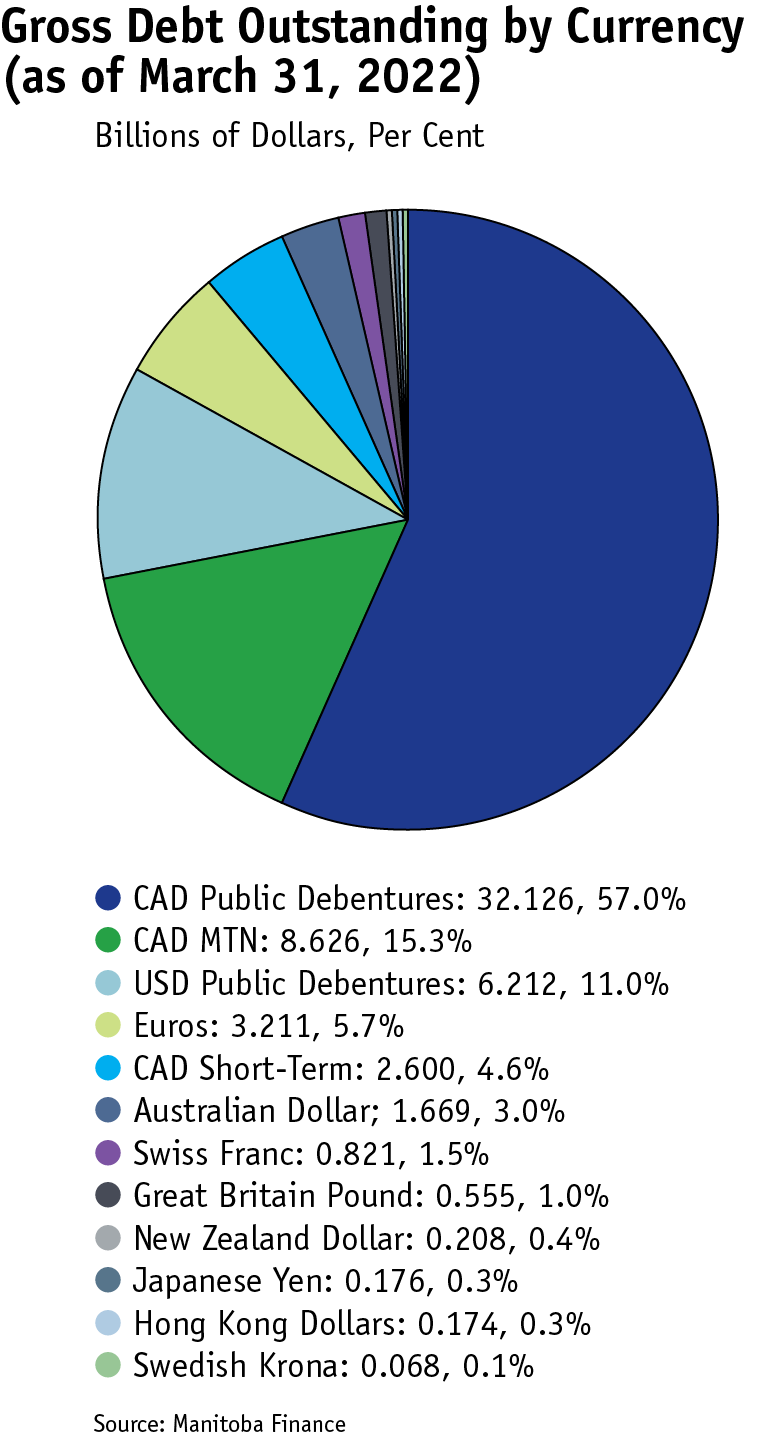

Manitoba also borrows in international markets. The province has formal programs filed with the regulators in the United States, Europe and Australia. There are a number of benefits of utilizing foreign markets. The first is investor diversification. Purchasers of Manitoba bonds often have limits on how much they can hold of a specific credit and by increasing the investor universe; it improves access to capital to meet borrowing requirements. It also indicates to primary investors in the domestic market that Manitoba has alternative sources of capital, which helps stabilize the spreads in Canada. Lastly, Manitoba will only borrow in international markets if the costs are competitive, which can generate savings when compared to issuing in the domestic market. The Manitoba government does not take on any foreign currency risk on the back of international issuance with all borrowing swapped to Canadian dollars.

A key component of Manitoba Finance&aposs debt management strategy is the use of derivative instruments to manage financial risks and to mitigate the following:

- Asset Liability Risk – Alter pattern or characteristics of debt service payments to facilitate a balanced asset and liability match of the Loans and Advances program.

- Foreign Currency Risk – To eliminate foreign exchange exposure while taking advantage of pricing arbitrage by facilitating offshore funding.

- Interest Rate Risk – To provide financial stability by reducing the impact of interest rate volatility.

- Refinancing Risk – Provide long-term interest rate protection required to match long-term funding obligations.

Given the amount of financial risk inherent within the Manitoba government’s borrowing and debt management activities, it was determined that a more sophisticated system is needed to manage this risk. The Treasury Division is in the process of selecting a new Treasury Management System. It will meet modern standards, best practices, and satisfy Treasury’s specific and critical business and risk requirements. From the new system, the division will develop enhanced value-added reporting, as well as more robust risk management and forecasting models.

As Manitoba is competing with other entities for a finite amount of investor capital, it is imperative the purchasers of Manitoba’s bonds are continually updated on the financial and strategic objectives. The province participates in government finance conferences, and has regular meetings with investors to ensure they have the most up-to-date credit information on Manitoba before making investment decisions. Investors also utilize reports from the credit rating agencies to facilitate their evaluation of the province and Manitoba Finance officials are regularly engaged with these agencies to ensure they are fully apprised on the economic, financial and fiscal environment in Manitoba.

Liquidity

The amount of liquidity Manitoba decides to hold is dependent on the uncertainty in capital markets due to unforeseen events such as a pandemic. The COVID-19 pandemic continued throughout the 2021/22 fiscal year, creating a significant amount of fluidity as to the actual amount of cash needed to meet the province’s cash requirements due to higher health costs and COVID-19 related support programs. As a result, the government made the strategic decision to maintain a larger liquidity position. Historically, Manitoba maintains approximately three months of cash requirements on hand but has now increased this position to six months of requirements. These reserves are made up of cash on hand plus investments in the Fiscal Stabilization Account and the Provincial Sinking Fund. Manitoba invests only in high-quality liquid instruments such as Government of Canada, provincial government, and municipal bonds.

The Manitoba government intends to return to

pre-

COVID-19

levels of liquidity once the pandemic is over.

2021/22 Borrowing Update

As of March 31, 2022, the Manitoba government has raised $4.6 billion in 2021/22. This includes approximately six months of prefunding for 2022/23.

Manitoba raised 60 per cent of its requirements in the Canadian domestic markets, which includes long-term bond issues and an increase to the existing short-term Treasury Bills program. The Manitoba government also issued in international markets including a seven-year United States dollar benchmark bond, a number of European private placements, and Australian and New Zealand dollar issues.

Current outstanding gross debt, as of March 31, 2022, is $56.5 billion.

2022/23 Borrowing Requirements

Borrowing requirements in 2022/23 are forecast to be $4.7 billion. This amount includes $1.6 billion of prefunding for the next fiscal year, which is in line with the present practice of staying six months ahead of cash needs. Domestic as well as international capital markets will be accessed to complete this program.

|

Borrowing Requirements 2022/23 |

|||||||

|

Refinancing |

New Cash Requirements |

Estimated Repayments |

Gross Borrowing Repayments |

Pre-Borrowed

|

Pre-Funding March 31, 2023 |

Borrowing Requirements |

|

|

(Millions of Dollars) |

|||||||

|

Government Business Enterprises |

|||||||

|

Manitoba Hydro-Electric Board |

1,151 |

300 |

- |

1,451 |

- |

- |

1,451 |

|

Manitoba Liquor and Lotteries Corporation |

75 |

70 |

55 |

90 |

- |

- |

90 |

|

Subtotal |

1,226 |

370 |

55 |

1,541 |

- |

- |

1,541 |

|

Other Borrowings |

|||||||

|

General Purpose Borrowings |

893 |

366 |

- |

1,259 |

1,152 |

721 |

828 |

|

Capital Investment Assets |

531 |

949 |

344 |

1,136 |

357 |

425 |

1,204 |

|

Health Facilities |

- |

200 |

125 |

75 |

- |

196 |

271 |

|

Other Crowns and Organizations |

75 |

509 |

276 |

308 |

- |

302 |

610 |

|

Public School Divisions |

- |

260 |

39 |

221 |

- |

- |

221 |

|

Subtotal |

1,499 |

2,284 |

784 |

2,999 |

1,509 |

1,644 |

3,134 |

|

Total Borrowing Requirements |

2,725 |

2,654 |

839 |

4,540 |

1,509 |

1,644 |

4,675 |

Borrowing Requirement – Mid-Term Outlook

In line with the government’s fiscal strategy, new borrowing requirements for the government will continue to decrease as the fiscal position approaches balance in accordance with the Fiscal Responsibility and Taxpayers Protection Act. In addition, for the past number of years Manitoba Hydro’s capital needs were a significant portion of the Manitoba government’s new borrowing requirements. With Bipole III completed and construction of Keeyask in its final stages, Manitoba Hydro’s new cash requirements will be lower than previous years.

As a result, the medium-term borrowing forecast shows new cash requirements to average $1.92 billion per year, while refinancing of maturing debt will average approximately $3.35 billion per year. The following table outlines expected future borrowings.

|

Fiscal Year |

22/23 |

23/24 |

24/25 |

25/26 |

|

New Cash |

$1,814 |

$2,181 |

$1,965 |

$1,760 |

|

Refinancing |

$2,726 |

$3,236 |

$3,473 |

$3,965 |

|

Total |

$4,540 |

$5,417 |

$5,438 |

$5,725 |

|

In Millions of $ CAD Pre-funding amounts not included |

||||

Debt Servicing Costs

Summary public debt costs for 2021/22 are forecast to be $965 million, $29 million lower than Budget 2021, due to lower-than-expected interest rates and a decrease to borrowing requirements from budget.

For fiscal year 2022/23, summary public debt costs are forecasted to be $1,025 million.

With global inflation no longer being described as transitory, the major central banks have made it clear in recent communications that they will be increasing rates to battle inflation.

In line with the Bank of Canada’s January 2022 Monetary Policy statement, the bank increased the overnight rate to 0.50 per cent in March, and further increases are forecasted throughout 2022. The current situation in Ukraine, oil, and commodity prices will be carefully monitored to assess the impact on the economy and inflation.

The “Governing Council expects interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving the 2 per cent inflation target”. As a result, Manitoba finance is expecting upward pressure on borrowing costs during the fiscal year.

Manitoba’s forecast average interest rate for new term borrowings during 2022/23 is 3.25 per cent. A one-percentage point increase in interest rates for an entire year will result in an estimated increase in debt servicing costs of $49 million.

For fiscal year 2022/23, net debt is forecast to be $30,544 million.

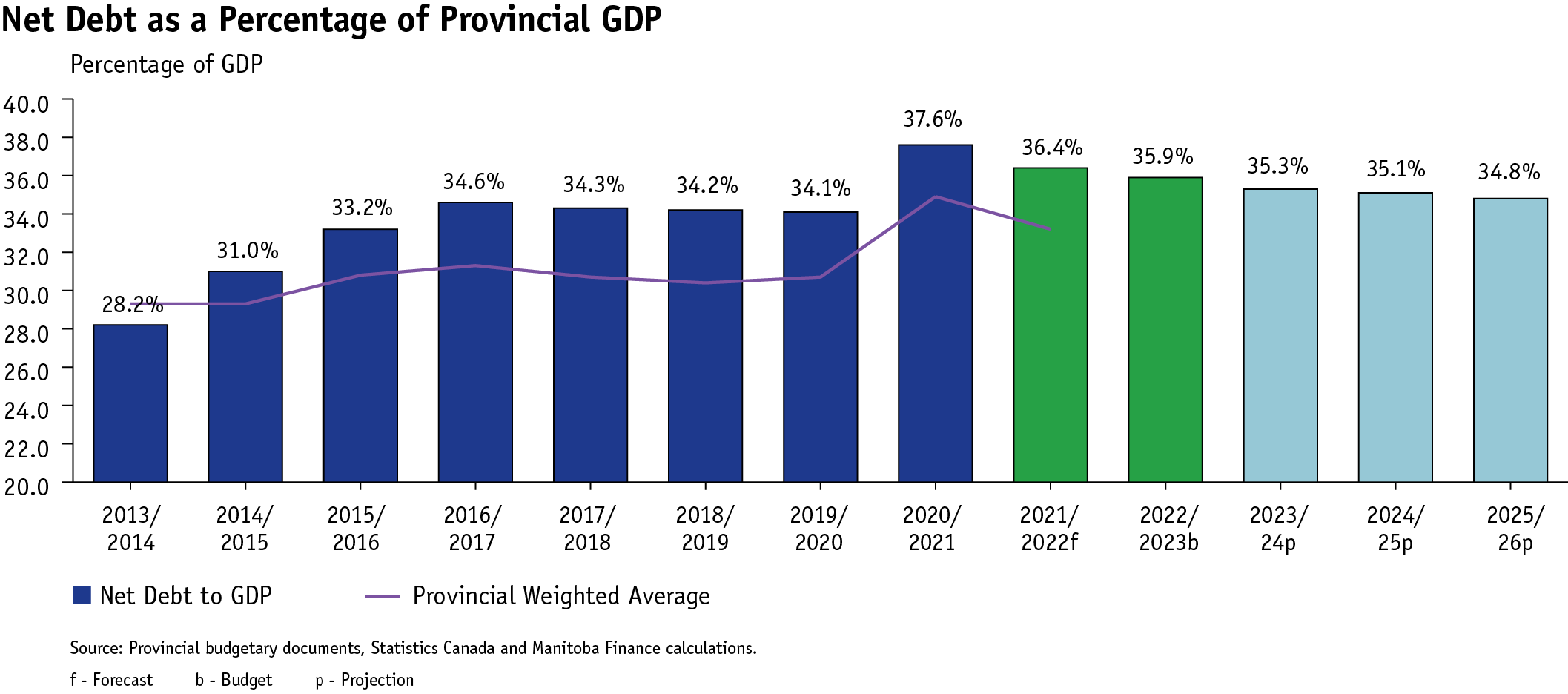

A key fiscal indicator for the government is the Net Debt as a Percentage of GDP. The objective is to keep the ratio in line with the weighted average for Canadian provinces. Keeping new cash requirements to a sustainable level during periods of economic growth will give the government more flexibility to allocate resources to Manitobans’ priorities.