Waste Reduction & Recycling Support

Frequently Asked Questions

HOW CAN WE HELP YOU?

Browse Topics

The WRARS levy is a $10 per tonne fee on all waste disposed at waste management facilities in Manitoba. The WRARS levy was established in 2009, under The Waste Reduction and Prevention Act, to help discourage waste generation and encourage recycling and waste diversion activities.

The levy is applicable to all

- municipal solid waste

- residential waste

- industrial, commercial and institutional waste

- construction, renovation and demolition waste

- all other waste

Burning waste is considered disposal. For waste burned at landfills and waste transfer stations under the authority of a burning permit, the owner must report the weight of waste disposed through burning and remit the $10 per tonne WRARS levy. This includes woody debris and cardboard.

The owners of waste management facilities (e.g., landfills, waste transfer stations) pay the WRARS levy to Manitoba Environment and Climate Change. These include municipalities, Northern Affairs communities, private facilities, and government departments.

Yes. They include:

- single-use private landfills that do not accept waste from other generators or from municipal sources

- First Nation waste disposal grounds that do not accept waste from other generators

- First Nations' waste disposed in Northern Affairs community landfills

- Diverted material from landfills, such as through recycling, composting, and wood waste chipping.

Waste management facility owners must send the $10 per tonne WRARS Levy to Environment and Climate Change for each six-month period per year:

- For the Jan. 1 to June 30 period, the deadline is July 31 of that year.

- For the July 1 to Dec. 31 period, the deadline is Jan. 31 of the following calendar year.

Landfill owners that use the per capita waste factor may send payment for both six-month periods in a calendar year by July 31 of that year.

Waste management facility owners are encouraged to report disposed waste online through the WRARS system. To request login access, please email recyclemb@gov.mb.ca. Reporting forms are also available here and can be emailed to recyclemb@gov.mb.ca when completed.

The WRARS levy can be paid by cheque or electronic fund transfer (EFT).

Cheques: Make cheques payable to the Minister of Finance.

Send cheques by mail to:

WRARS Program

Environment and Climate Change

Box 37 - 14 Fultz Blvd

Winnipeg, MB R3Y 0L6

Cheques may be delivered to:

14 Fultz Blvd, Winnipeg, MB R3Y 0L6, ATTN: Box 37 WRARS Program

Electric Fund Transfer (EFT): Contact recyclemb@gov.mb.ca for more information.

Waste management facilities that do not have a weigh scale can either estimate disposed waste or use the per capita waste factor.

Estimating waste: Waste management facility operators can measure the volume of waste disposed/burned and convert to tonnes. See Section 6 and Appendix C: Guide to Waste Estimation at Landfills without Weigh Scales in the WRARS Guide, for more details.

When reporting estimated waste, provide supporting calculations to recyclemb@gov.mb.ca.

Per capita waste factor: The WRARS levy can be calculated using a six-month per capita waste factor of 330 kilograms (0.33 tonnes). This rate is based on the measured average per capita waste disposed at landfills outside of the Capital Region and Brandon. Waste management facility owners should use the census data for the per capita waste factor, which is accessible in the WRARS system.

Here is an example of calculating a six-month WRARS levy using a population of 1,000 people:

1,000 x 0.33 tonnes = 330 tonnes of waste

330 tonnes x $10/tonne = $3,300

The WRARS system will calculate the levy based on estimated waste or the per capita waste factor.

A waste transfer station owner does not pay the WRARS levy on waste transported from the waste transfer station to a landfill. The owner of the landfill where the waste is sent will pay the WRARS levy on that waste. If waste is burned at a waste transfer station under the authority of a burning permit, the owner must report the weight of waste disposed through burning and pay the $10 per tonne WRARS levy.

Closing a waste disposal ground or converting a waste disposal ground into a waste transfer station will influence the WRARS levy owed. Please inform WRARS Program staff of any changes at recyclemb@gov.mb.ca.

All waste transfer stations, regardless if they were or were not converted from a landfill, must be registered with the WRARS Program by the owner. Please complete a Landfill Closure Confirmation and Waste Transfer Station Registration Form or a Landfill and Waste Transfer Station Registration Form and submit to recyclemb@gov.mb.ca.

A municipality that has its waste hauled to a landfill not owned by that municipality will not pay a WRARS levy on that waste. The owner of the landfill where the waste is sent will pay the WRARS levy on that waste. However, if a municipality stores or burns any waste at a waste management facility it owns, the municipality will pay the WRARS levy on that disposed or burned waste.

If a portion of a municipality's waste is hauled to a landfill not owned by that municipality, and the municipality uses the per capita waste factor to pay the WRARS levy, the municipality should report on a reduced population. For example, if a municipality of 1,000 people hauls about 30 per cent of its waste to a landfill not owned by that municipality, the municipality should pay the per capita rate of the WRARS levy for 70 per cent of its population (700 people).

Owners of landfills accepting waste from multiple municipalities should list all municipalities served in the "Catchment" field in the WRARS system. For the "Population served" field, count only the population of municipalities in which the majority of residential waste is collected. For example, if only construction, renovation and demolition waste is collected from a municipality, list that municipality in the "Catchment" field, but do not include its population in the "Population served" field.

Please complete the online form here.

Recycling rebates are financial incentives to municipalities and Northern Affairs communities for recycling packaging and printed paper (blue bin materials).

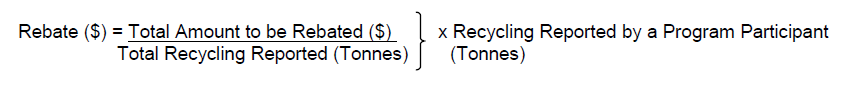

Rebates are based on the percentage share of the total recycled printed paper and packaging tonnage reported. The formula for calculating how much a municipality or Northern Affairs community receives for each six-month period is:

Recycling rebates for each participating jurisdiction are calculated once all eligible recycling reports are received by Manitoba Environment and Climate Change. Eligible program participants will receive rebate summary reports outlining the amount they are to receive before the disbursement of the rebates.

Recycling rebates are available to municipalities and Northern Affairs communities that

- operate a WRARS registered waste management facility (and pay the WRARS levy on its disposed waste by the deadline), and/or have a contract with a WRARS registered landfill for disposal of municipal solid waste

- have an agreement with Multi-Material Stewardship Manitoba (MMSM)

- submit a recycling rebate report to Environment and Climate Change by the deadline.

First Nations may also receive recycling rebates by voluntarily fulfilling the eligibility criteria.

Municipalities and Northern Affairs communities are encouraged to report their recycling online through the WRARS system. To request login access, please email recyclemb@gov.mb.ca. Reporting forms are also available here and can be emailed to recyclemb@gov.mb.ca when completed.

The recycling rebate report schedule follows the WRARS levy schedule. Recycling rebate reports are received by Manitoba Environment and Climate Change for each six-month period per year:

- For the Jan. 1 to June 30 period, the deadline is July 31 of that year.

- For the July 1 to Dec. 31 period, the deadline is Jan. 31 of the following calendar year.

The recycling rebates are determined once all Northern Affairs communities and municipalities submit their recycling rebate reports to the department. The rebates are paid out within 60 days following the recycling rebate report submission deadlines. Municipalities and Northern Affairs communities will receive a rebate report with the rebate amount shortly before the rebates are paid out.

| Six-month period | Deadline for recycling rebate report submission to the department | Recycling Rebate pay-out date |

|---|---|---|

| Jan. 1 to June 30 | July 31 | By Sept. 30 |

| July 1 to Dec. 31 | Jan. 31 of the following calendar year | By March 31 of the following calendar year |

The WRARS system is a web-based platform used to submit both WRARS levy remittance reports and recycling rebate reports.

Visit https://wrars.ca and click Login. Registered participants can request a user account from recyclemb@gov.mb.ca.

Refer to the instructions for submitting a WRARS levy remittance report in the WRARS system.

Refer to the instructions for submitting a Recycling Rebate Report in the WRARS system.

You can request a user account from recyclemb@gov.mb.ca. If you forget your password, you can click on "Forgot your password?" below the log in fields. This will send an email to the user's email address to reset the password.

Please contact the WRARS program staff at recyclemb@gov.mb.ca if you need any assistance with the WRARS system.