Information and Cultural Industries

Examples include but are not limited to:

- Information and Communications

Technology - Video Game Development

- Film and Media Production

The Opportunities for Economic Growth Action Plan was developed through extensive research and analysis using a customised methodology developed in partnership with the Manitoba Bureau of Statistics. To enhance our research, we shared this analysis with internal and external stakeholders who provided important observations and insights into our findings.

Our research focused on two key areas that will influence our current and future economic performance:

The Opportunities for Economic Growth Action Plan builds on the findings and advice of the 2018 Growing Manitoba’s Economy report and establishes new actions in response to emerging economic and workforce trends.

Through extensive stakeholder engagement led by co-chairs Barb Gamey and Dave Angus, the Growing Manitoba’s Economy report identified Manitoba’s key advantages and drivers of growth, and recommended the use of a coordinated, cross-government approach to economic development that is the basis for our current action plan.

The full report can be viewed here.

Note: Sector data is organized according to the North American Industry Classification System.

This analysis used a collection of 25 different data sets related to economic growth to help us better understand our competitive advantages and future opportunities for growth. Key findings of this analysis are presented below:

Our research determined that the following four sectors are well established in Manitoba and on track for continued growth over the next 5-7 years:

Information and Cultural Industries

Examples include but are not limited to:

Retail Trade

Examples include but are not limited to:

Manufacturing

Examples include but are not limited to:

Agriculture, Forestry, Fishing

and Hunting

Examples include but are not limited to:

Our analysis also determined that Manitoba is well-positioned to capitalize on five emerging global trends that will help accelerate our economic growth over the next several years:

Mining

Sustainable Agriculture

Chemical (Biosciences)

Manufacturing

Digital Services

Energy

Note: Occupational data is organized based on the National Occupational Classification System.

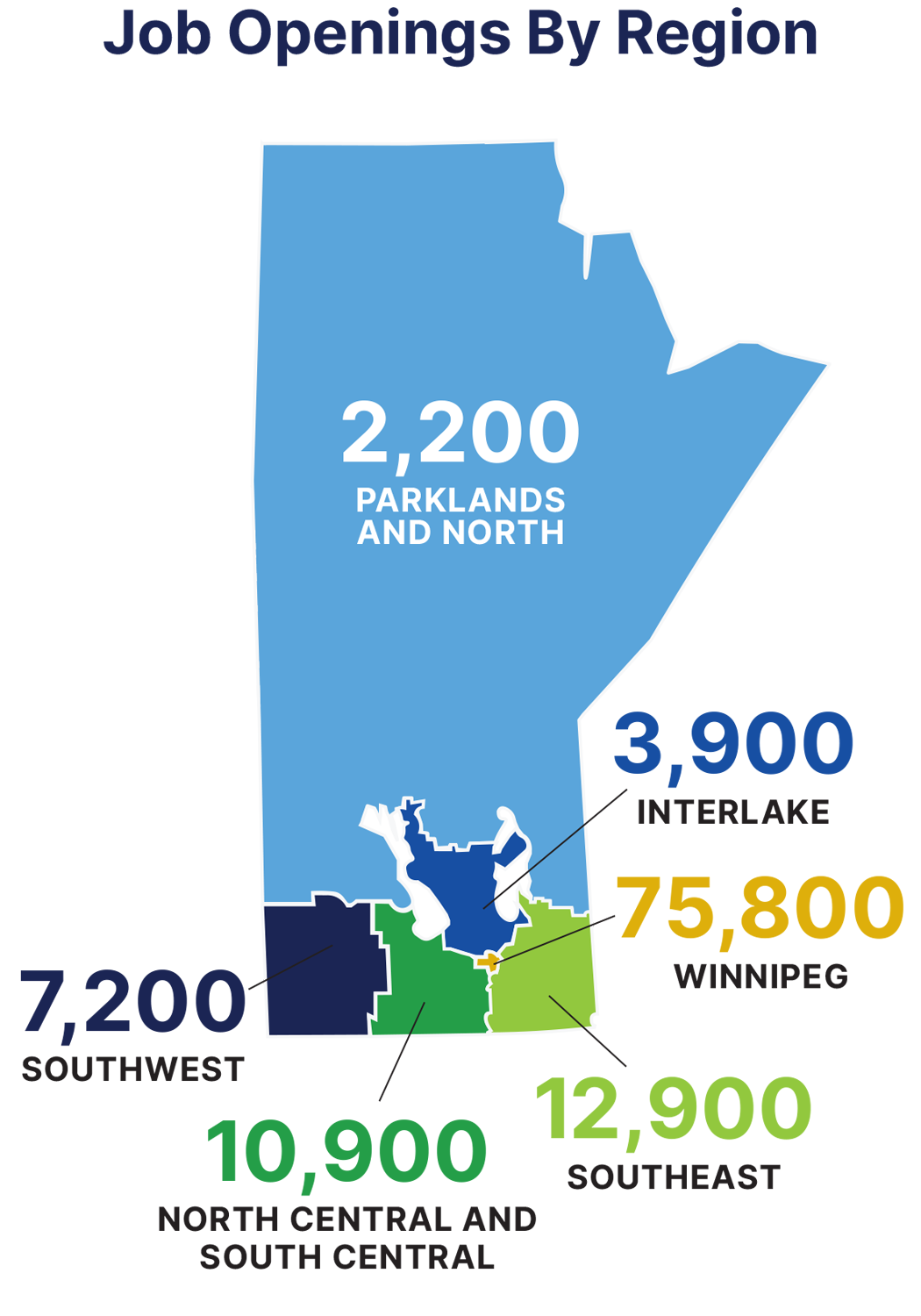

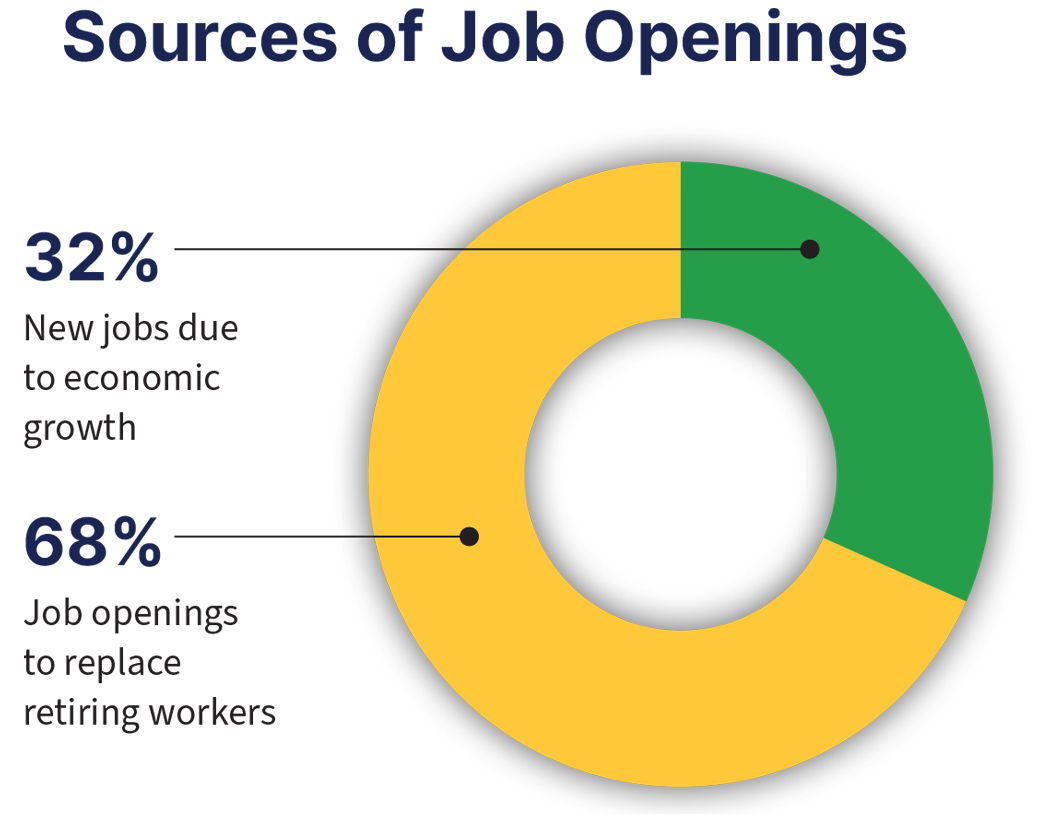

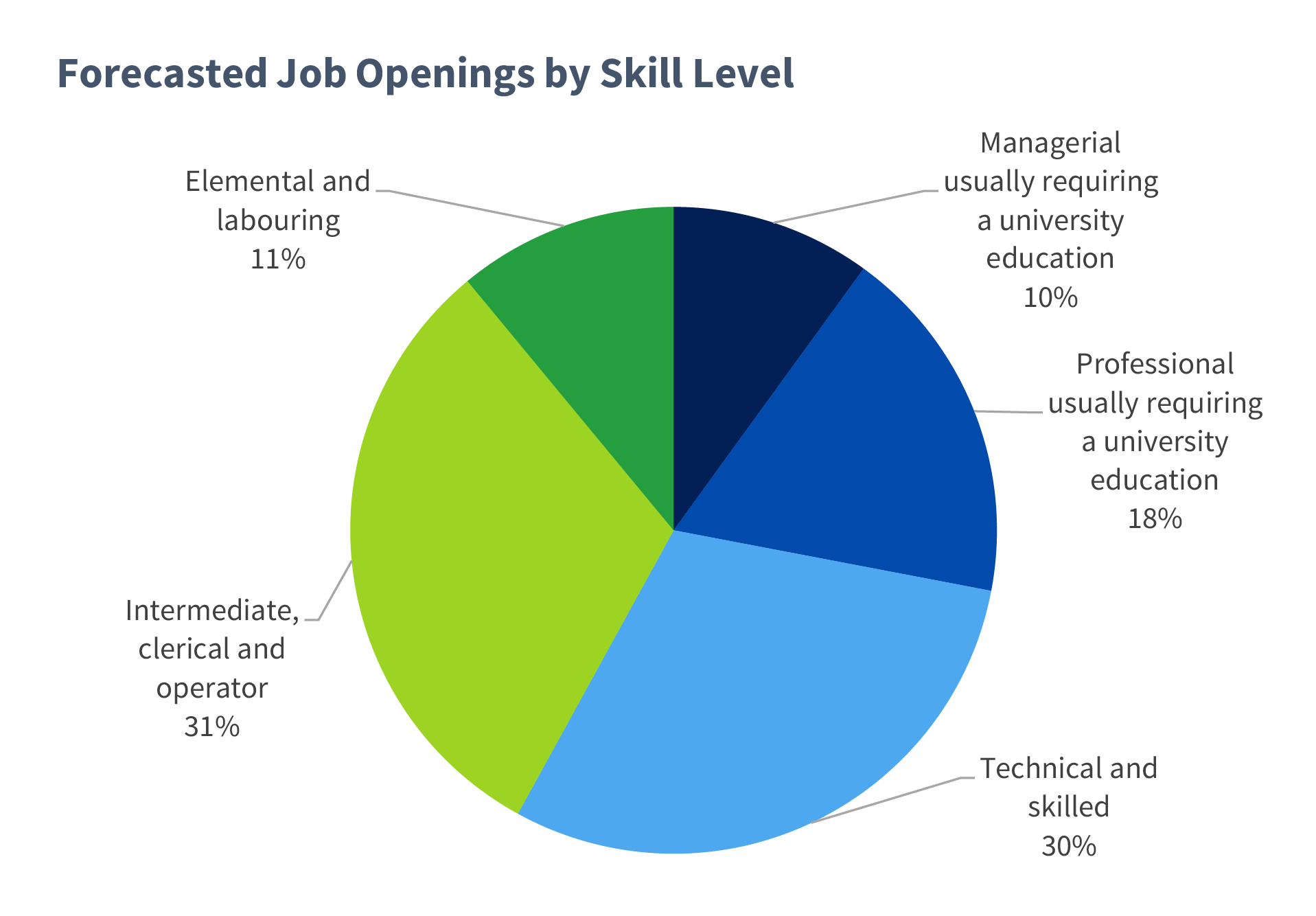

A skilled and diverse workforce is essential to our continued economic performance and future growth. To assess our future workforce needs and challenges, our research focused on projected labour market demand and workforce availability across all sectors.

For more detailed labour market information including workforce trends, regional forecasts and future occupational needs, please visit the Manitoba Labour Market Outlook website.

| Occupational Group | Projected Job Openings 2022-2026 |

|---|---|

| Sales and service | 25,100 |

| Trades, transport and equipment operators | 17,600 |

| Business, finance and administration | 17,200 |

| Management | 11,600 |

| Natural and applied sciences | 4,600 |

| Occupation | Projected Worker Shortage 2022-2026 |

|---|---|

| Transport truck drivers | 2,350 |

| Retail and wholesale trade managers | 1,475 |

| Hairstylists and barbers | 995 |

| Automotive service technicians, truck and bus mechanics and mechanical repairers | 995 |

| Retail salespersons | 910 |

Our forecast indicates that 58% of job openings over five years will require post-secondary education which includes university degrees or certification and technical or skilled program certification, such as a college diploma.

|

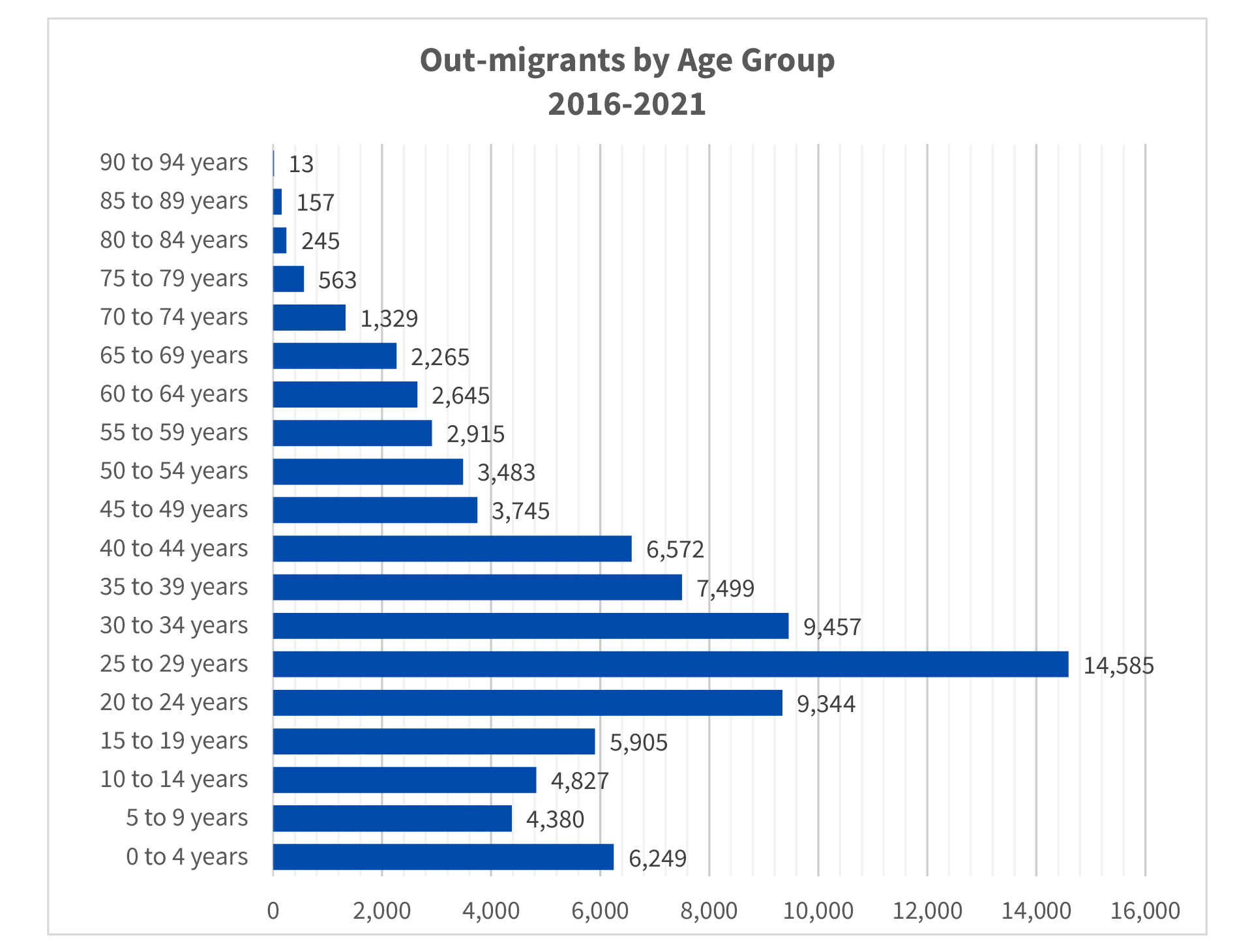

Research shows us that a significant number of people leave Manitoba annually to live in other parts of Canada. Over the last five years, Manitoba has lost 7,500 more people each year to other Canadian jurisdictions than it has gained.

Of these out-migrants, 52% are 25-54 years old, which is considered core working age. The age group with the greatest number of out-migrants is 25-29 years of age.

|

University-educated individuals are over-represented amongst out-migrants. 32.9% of Manitoba out-migrants have completed university education at the bachelor level or above, compared to 20.1% of the general population.