Programs and Incentives

Innovation Growth Program

This webpage is intended to assist prospective participants in determining their eligibility and completing their application under the Innovation Growth Program (IGP). This is a general guide which will be updated on an ongoing basis. Because of the unique nature of each project, the guide cannot take into consideration every potential project scenario.

News Releases

- June 16, 2025 - Manitoba Government Invests More Than $640,000 in Local Businesses

- October 16, 2024 - Manitoba Government Supports Growth of Local Companies

- December 20, 2023 - Manitoba Government Helping Five Local Companies Grow

- August 1, 2023 - Manitoba Government Invests $1 Million into Local Business Innovations

- April 12, 2023 - Manitoba Government Provides $400,000 for Latest Intake of Innovation Growth Program

- November 9, 2022 - Manitoba Government Provides more than $900,000 to Businesses Through Innovation Growth Program

- June 28, 2022 - Manitoba Government Allocates Additional $286,500 to Businesses through Innovation Growth Program

Download Application Support Document

Information on Start Up Letter for New Companies

Available in alternate formats upon request.

Contact information:

Economic Programs Branch

1010 - 259 Portage Avenue

Winnipeg, MB R3B 3P4

General email: ecdevprograms@gov.mb.ca

General phone number: 204-945-7343

The IGP provides cost-sharing assistance to Small and Medium-Sized Enterprises (SMEs) to assist them in commercializing new innovative products and processes. The IGP will support SMEs in the development and growth stages of the business life-cycle to reduce the risks associated with the commercialization of innovative products and processes, accelerate growth and strengthen their financial position so they can secure future funding to build their Manitoba-based business.

Under the IGP, firms may apply for a non-repayable grant of up to $100,000 per project to cost-share eligible expenses on a 50/50 basis. The IGP approves projects using a competitive process. Only the strongest applications that meet the objectives of the program will be considered for funding.

The objectives of the program are to:

- Commercialize innovative products or processes

- Leverage private sector investment in new products

- Create economic growth

- Create jobs

- Grow exports

Applicants must meet the eligibility criteria at the time of application for the IGP.

Eligible applicants:

- For-profit, taxable Canadian Controlled Private Corporations with a permanent establishment in Manitoba that pay at least 50% of total salaries and wages to Manitoba resident employees.

- Annual revenue of $15 million or less, or fewer than 100 full time equivalent employees, including its affiliates on a consolidated basis.

- Company demonstrates a $25,000, or greater, cash equity position. Cash equity is defined as a minimum of $25,000 in common or preferred shares invested in the company and/or retained earnings of $25,000 or more.

Ineligible applicants:

- Not-for-profit organizations.

- Professional practices which are regulated by a governing body of the profession under an Act of the Legislature.

- Business operations primarily earning passive income.

- Crown corporations, municipalities, towns and cities, or organizations owned or controlled by one of those groups

Note: IGP is intended to support business ventures that do not qualify for other forms of Government of Manitoba financial assistance. Depending on the nature of the project, companies that qualify for assistance through other Government of Manitoba financial assistance programs will be directed to apply under those programs first.

Eligible applicants can apply for the following commercialization activities under IGP:

- building commercial scale prototypes (software projects excluded)

- trial runs in an operational environment, market testing

- obtaining certification, and registering intellectual property

- manufacturing tooling, dies or moulds for prototype or production

- adapting commercially viable products for a new market

- market development or expansion activities

- commercial scale up activities, such as testing, obtaining certifications, packaging, translation, etc.

- internal salaries and wages for net new Manitoba employees who are working directly on an approved project where a T4 is issued. Qualifying employees must be hired after the program intake deadline. Support for new Manitoba hires is capped at 50% of total funding requested under IGP.

Innovation is:

- Innovation in the context of the IGP is defined as a product or process that is not currently available in the market.

- Significant modifications to existing products or processes that are applied in a setting or condition for which current technology applications are not possible or feasible; or

- An improvement to an existing technology/process that represents a significant (generally patentable) improvement in functionality, cost or performance of goods and services that are considered state of the art or the current industry best practice.

Innovation is not:

- Product enhancements, incremental improvements, "good engineering" and technologies that would go ahead in a normal course of product development (i.e. the next version or release).

Eligible Costs

Eligible costs are expenses relating to the execution of eligible activities pertaining to an approved project. As part of the application form, the applicant must provide detailed costs associated with each activity for which assistance is being requested. The applicant will be responsible for all costs related to the project, including all ineligible costs and cost overruns. Due to the uniqueness of the projects submitted, the list of eligible and ineligible costs is not exhaustive and applicants are encouraged to list all their project costs.

Eligible Costs:

- Legal fees associated with registration of intellectual property

- Designing and building of commercial scale prototypes

- Tools, moulds

- Testing costs, certifications

- Third party advisory or technical services

- Business to business tradeshows or events intended to secure distributors

- Internal salaries and wages for net new Manitoba hires working directly on the project where a T4 is issued. New hires support is capped at 50% of total IGP funding requested.

Ineligible Costs:

- Advertising

- Land and buildings

- Equipment

- Inventory

- Internal labour, except for qualifying net new hires

- Owner salary or dividends

- Primary research and development

- Website development

- Business registration and incorporation costs

- Costs for entertainment, meals, alcohol, lodging or per diems

- Shipping expenses

- Professional dues, membership fees

- Financing charges and taxes

- Business plans

- Costs not directly attributable to product commercialization

- Activities relating to productivity improvements

- The IGP provides a non-repayable grant of up to $100,000 per project to cost share eligible expenses on a 50/50 cost shared basis.

- Project activities must be completed (incurred and paid) within one year of the application intake closing date.

- At least 50 per cent of eligible project costs must be supported by non-government sources and funding from non-government sources must be confirmed at the time of application.

- Funding is capped at $100,000 per new project per corporation, including any affiliated corporations (same controlling shareholder or group of shareholders). An applicant may only have one active project in process at any given time.

- Eligible applicants will be required to enter into a 6-year funding and reporting agreement with Manitoba Business, Mining, Trade and Job Creation.

Funding Disbursement

Reimbursement is based on satisfactory proof of payment for expenses incurred in accordance with the terms of the funding agreement. Information on the reimbursement process will be included in the funding agreement. IGP will not reimburse project expenses incurred prior to application intake closing date.

Other Government Assistance

The Government of Manitoba’s total contribution will not exceed 50 per cent of total project costs. Total government support from all levels of government (federal, provincial, municipal), including tax rebates (excluding: equity tax credits, Scientific Research and Experimental Development Tax Credit and Paid Work Experience Tax Credit), cannot exceed 50 per cent of total project costs.

No applications will be accepted after the closing intake date.

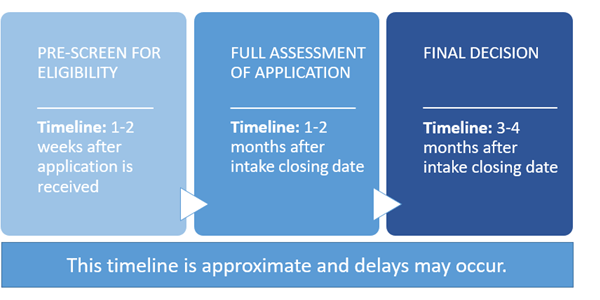

The department performs a pre-screen of all applications received. The pre-screen helps to ensure the application is eligible and complete. The pre-screen is not an assessment of the application. You may be contacted by the department during the pre-screen if your application is incomplete. Applicants that are not selected will be contacted by the department and provided with feedback to amend their application for re-submission in future intakes.

The IGP is a competitive process and applications will be evaluated against other proposals received during the intake phase. A review panel and subject matter experts, as required, will evaluate full proposals.

Criteria

The review panel will evaluate the ability of all applicants to achieve IGP objectives using the following selection criteria:

A. Quality of The Project

- Demonstrates a clear and comprehensive description of the proposed innovation;

- Demonstrates clear and focused objectives and includes a work plan with appropriate methodology, timelines, and deliverables;

- Demonstrates that the project is scientifically sound, technically feasible, and shows promise to generate new knowledge or to apply existing knowledge in an innovative manner; and

- Demonstrates innovation and includes key features and benefits that offer an advantage over the competition.

B. Market for the Innovation

- There is a defined market need, sufficient market size, and/or evidence of market growth;

- There is an assessment of risk and evidence of plan to mitigate the risks;

- Demonstrates a comprehensive industry assessment has been conducted and identifies key competitors;

- Demonstrates the proposed innovation has key features and benefits that offer an advantage over the competition;

- Demonstrates the likelihood of broad customer acquisition in a large market or market dominance in a narrow market segment;

C. Management Capacity

- Demonstrates a strong lead champion with the capacity to guide the project to completion;

- The team has the technical, managerial, financial, business, and legal expertise relevant to their respective industry that will enable them to move the proposed innovation to market;

- Demonstrates an Intellectual Property strategy for the proposed innovation that is appropriate for their respective sector or industry (if necessary).

D. Commercialization Plan and Business Model

- Demonstrates an adequate financial and commercialization strategy with the capacity, resources, and expertise to move the innovation to commercial markets;

- Demonstrates that the applicant’s go-to-market plan includes the necessary equipment and infrastructure required to move the proposed innovation to market;

- Demonstrates the applicant has adequately identified and addressed the challenges and risks of commercialization (including technical challenges and anticipated reaction of large competitors); and

- Demonstrates a realistic and coherent timeline with achievable milestones and deliverables.

E. Investments Secured

- Demonstrates that the need for the financial request from IGP is reasonable given the project costs outlined in the budget;

- Demonstrates a reasonable level of matching funds to complete the proposed project.

F. Benefits to Manitoba

- Demonstrates that the project will lead to economic development benefits, including:

- Number of jobs created;

- Growth in company payroll;

- Sales targets;

- Export targets;

- Increased industry competitiveness;

- Incremental capital investment.

Submissions to the program must include:

- A completed IGP Application Form in Word format.

- A copy of the corporation's most recent T2 tax return and year-end Financial Statement including balance sheet and income statement of the applicant (for the last fiscal year) or a completed Start-up Letter. Download information on the Start-up Letter here.

- A current Balance Sheet and Income Statement of the applicant (no older than three months).

- Proof of confirmed funding from all other sources at the time of application, including government and non-government (non-government funding must represent at least 50 per cent of the proposed project costs).

Other relevant information, such as business plans, marketing plans and market validation studies, may be included in support of the application.

For a detailed list of eligibility and application requirements, download the Application Form.

- Please submit an electronic copy of your completed IGP Application by the application closing date, with the necessary supporting documentation to:

Innovation Growth Program

Manitoba Business, Mining, Trade and Job Creation

Email: ecdevprograms@gov.mb.ca

Phone: 204-945-7343

- If you require your documents to be submitted through a secure channel other than Government of Manitoba email, please contact the department at ecdevprograms@gov.mb.ca.

Recipients of funding will be contacted annually for five years following project completion to collect performance data. The review will include telephone, email, and/or in-person interviews following up on the project and measuring overall company growth using such methods as financial statement reviews and collection of company issued T4 information. Data will be collected on company revenue, export revenue, employment numbers, company payroll and investment leveraged. Additional reporting details will be provided in the funding agreement.